The rising cost of housing is driven by increasing demand and limited supply, creating significant challenges for renters.

Data from ELSTAT reveals that rents rose by 10.8% in 2025 compared to 2024. Additionally, the expenses for home repair and maintenance grew by 5.9%, while home-related services saw an increase of 2.1%. A recent study by Alpha Bank highlights that 52% of tenants are spending more than 30% of their income on rent.

These statistics align with the Bank of Greece’s report, which indicated that apartment prices surged by 8.7% year-on-year, following even sharper increases of 13.9% in 2023 and 11.9% in 2022.

Specifically, the prices of new apartments (those under 5 years old) increased at an average annual rate of 10.1% in 2024, compared to a 7.8% increase for older apartments, attributed to the ongoing rise in material costs.

Construction industry leaders estimate that construction costs have doubled since the economic crisis.

As apartment values soar, more citizens are turning to rental options.

Several factors contribute to the imbalance between housing supply and demand.

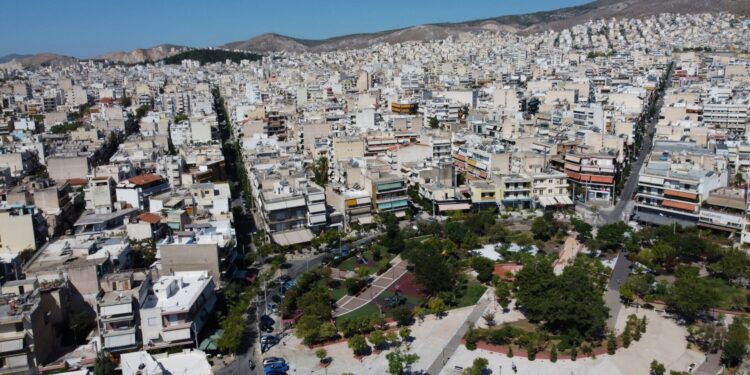

According to recent census and market data, Greece has around 794,000 vacant homes, predominantly located in urban areas. Utilizing these homes could help mitigate the rental housing shortage.

Moreover, the building stock is aging, with 64% of homes over 30 years old. Renovations are often impractical for many households, especially due to the rising costs of materials.